Provided Financial Assistance for the construction of Sarojini Padmanabhan Memorial Auditorium in Aluva

Smt. Sarojini Padmanabhan Memorial Women's Club organised a lecture of Alappuzha District Collector Sri. Krishna Teja IAS at Manappuram Finance Ltd's Head Office on 10th Dec. 2022. The students from CA Academy, Principals and Teachers from Mukundapuram Public School & Mageet School, Womens Club members and employees of the company attended.

MD & CEO Sri. V.P. Nandakumar addressed the audience and stated that it was a wonderful opportunity for the employees and students to listen to an inspiring pesonality like Krishna Teja. The chief guest was introduced to the audience by Dr Sumitha Nandan.

In his speech, Mr Krishna Teja took everyone through the journey of his life, how he overcame difficulties to become a topper in academics and how he passed the IAS exam on the fourth attempt.

To commemorate International Day of Disabled Persons, Manappuram Foundation organised a function on December 4 at Valapad along with the Valappad chapter of the assocation for the disabled. Nattika MLA C C Mukundan distributed food grain packets to 100 impoverished, disabled individuals

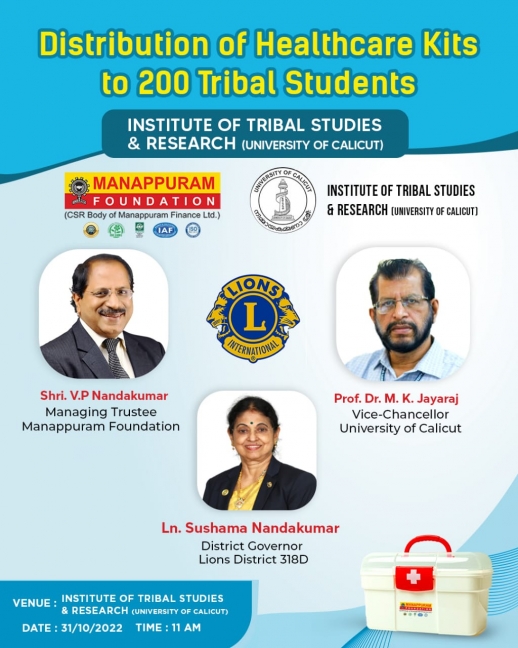

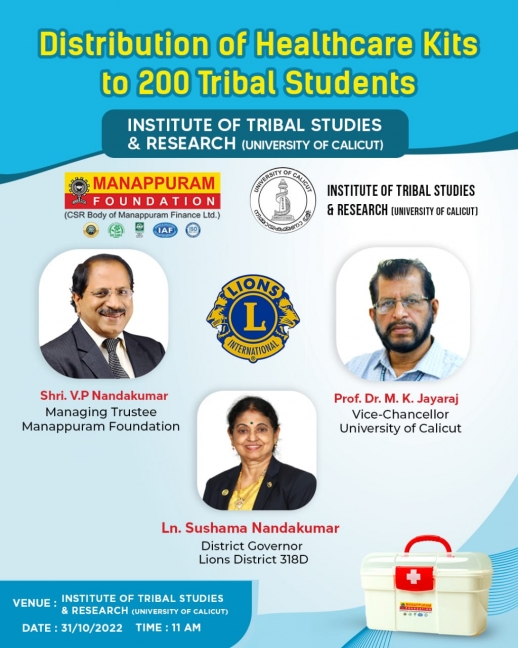

At Wayanad, Manappuram Foundation distributed healthcare kits to 200 tribal students attached to Tribal Studies Research Institute on October 31, 2022

Introduction

A gold loan is a popular product in India. It is a convenient and easy way to get a loan. However, it’s not that easy to find reliable lenders. You need to do your homework before availing of this loan product so that you don’t end up losing money by defaulting on payments or incurring late fees due to delayed payment cycles. In this article, we will discuss some basic things which should be considered before taking a gold loan so that you don't end up paying more than what was initially promised!

Manappuram Foundation distributing study tables and chairs to the Anganwadi at Ward 20 in Valapad, Thrissur district.

Getting a gold loan rate per gram of your gold at the lowest interest of gold loans is another story compared to the punctual repayment of the loan. A leveraged credit that the consumer obtains from a financial lender, such as a bank or non-banking financial company, on an agreement to repay the gold loan rate per gram along with the interest of gold loan, by pledging their gold items as collateral is known as a loan over your gold treasures.